What Happened?

In mid-December 2025, Funding Ticks and Funding Pips (both operated by CEO Khaled, known as @Khldfx on X/Twitter) implemented several rule changes that affected not only new customers, but existing account holders as well.

The changes triggered immediate backlash on social media, with traders reporting:

- •Profits being retroactively removed from their accounts

- •Payout requests denied after December 11th

- •Accounts forcibly moved to "live" status, resulting in lost gains

- •New trading restrictions that made passing challenges nearly impossible for some

The controversy highlights a critical issue in the prop firm industry: can firms change the rules mid-game?

The Three Retroactive Changes

Increased Maximum Loss

- • Max loss limits were increased for all accounts

- • Affects risk parameters traders originally agreed to

Profit Split Reduced to 80%

- • Previously higher splits (some report 90%+) reduced to 80%

- • CEO Khaled states this is now "industry standard"

HFT / 1-Minute Rule

- • New rule requiring minimum 1-minute trade duration

- • Trades under 1 minute no longer count toward profit targets

- • CRITICAL: Applied retroactively to existing accounts

Trader Testimonials

Negative Experiences

"This is bullshit: I paid for an account on certain conditions, consistently profited my edge during 3 weeks, and once I was about to pass them, the 1-minute rule made it virtually impossible for me to pass on the new conditions in just 3 usable days until expiration."

— @RomanBreakouts

"'I'm someone who paid out more than 220 M' - this is what we waited for? This guy literally said nothing. Beating around the bush and gave us a SOB story. FIX THE RULES AND GIVE PEOPLE BACK THEIR PROFITS!"

[Screenshot showing $19,959.35 in rewards across 28 payouts]

— @MaskedTraderNFA

"You can set whatever rules you want, it's your company. If they're bad, people just won't buy. But applying new rules retroactively, removing profits and resetting minimum days when people were nearly at payout is fucking disgusting behaviour."

— @OkoTrading

"The thing is you should've changed rules for new purchases. Imagine taking profits which took months ago? It's a perfect scam tactics. And many bots are supporting this tweet."

— @NinjaTrader_420

"A lot of people are being moved to live after having made 10k in profit (since you advertise up to 5k payouts @ 50% balance) and already having 5 profitable days. That feels like a GREAT timing to move only 7.5k to live and forfeit 2500$. I feel scammed honestly."

— @Albe_xt

"They been denying payouts since Dec 11th. Don't listen to this snake oil salesman. Introducing new rules is one thing but retroactively having rules apply to all accounts is theft."

— @jamison_munn

"Maybe you need to learn what HFT trading is. It's not a 10 sec trade. It's milliseconds done by algorithms etc. Changing the rules is one thing. Retroactively pushing the rules for past trades is another. That's the scam."

— @emdadR

Positive Experiences

"Appreciate you speaking up on this. Hoping to see some changes in favor of traders. A combined ~$60K in payouts across myself and my community has been processed even during this entire phase. Appreciate it!"

— @Sahiloo007

"I agree with Khaled. I don't have any problem with the rule change since I am not trying to game the system anyway. I did get $700 profit taken away but it's fine since that trade was under a minute but I make it back without problem. Do what you must to keep the firm sustainable!"

— @thangsochet

"I have been trading FP since it came out and now FT, though I am yet to find my success. We have a lot of options when buying an account, and as much as I wanted to switch after seeing these rule changes, I bought another FT 50k because I believe in what you are tryna create."

— @ragetradesx

Trustpilot Reviews Confirm the Pattern

Trustpilot Rating Collapse

Before Changes

4.3/5

After Changes

3.2/5

Drop

-25%

1,352 total reviews - with a surge of 1-star reviews in December 2025

December 2025 Trustpilot Reviews:

"They retroactively took $21,000 of profits from my accounts causing them all to be breached. They also stole $600 from my last payout. People should avoid this scam out of Dubai at all costs. The support refused to resolve my issues with copy paste responses."

— T B (US)

"The most outrageous part was watching them delete already-earned profits on trades under one minute, even though those trades were made before the rule existed. This isn't just bad policy. It's a complete breach of trust. A prop firm should support its traders, not move the goalposts whenever it benefits them."

— Monica (GB)

"They backdated and changed their payout rules. What a joke. Even if they go back to what it was after they realize they lost so many customers, I won't return. Shady company! Stole 1400 in profits I made the day before when they retroactively changed the rules on us."

— Matthew (US)

"Avoid this company at all costs. The latest batch of retroactive rule changes wiped out half of my profits and implemented rules that don't benefit anyone except the company. Removing legitimate profits from weeks prior is about as low as you can get. This is probably the worst prop firm in the industry, currently."

— D S (US)

"Scalping Rule: While scalping is permitted, profits from trades held for one minute or less will not be counted. All losses including commissions from these trades will be counted. If the profit deduction causes a violation of any other rule, the trader remains fully responsible."

— tm (US)

"You guys have to get rid of the 1 minute rule for scalpers. I place trades with limit order targets. I hope it's not too late for you guys with the amount of people that have already left the platform."

— Hunter (US)

"Retroactive change!!"

— Dadada (PH)

Note: This review from October suggests retroactive changes may have started before December.

CEO Response

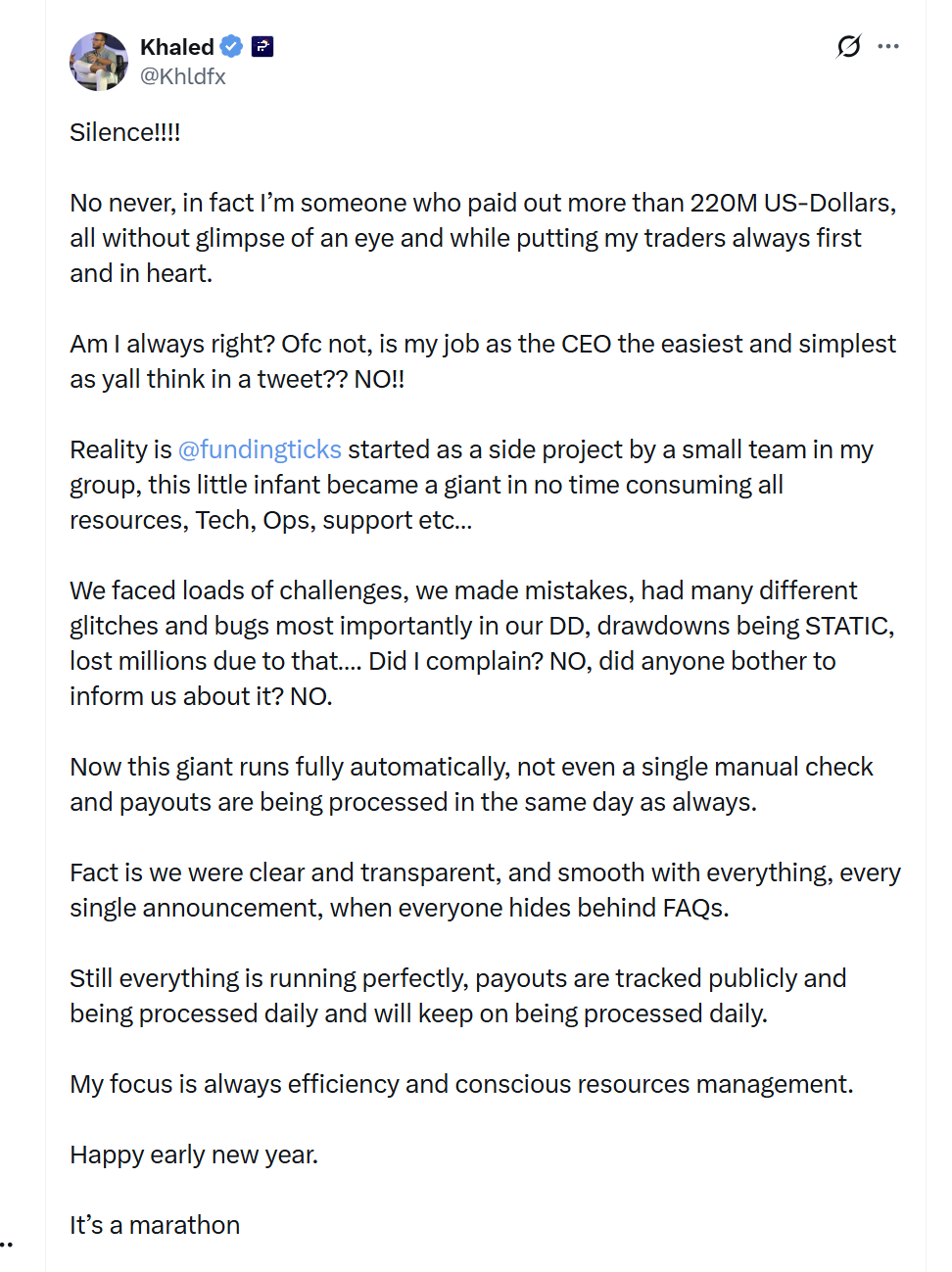

On December 23, 2025, Khaled (@Khldfx) posted a lengthy response on X/Twitter:

CEO Khaled's public response on X/Twitter

Key points from his statement:

"I'm someone who paid out more than 220M US-Dollars, all without glimpse of an eye and while putting my traders always first and in heart."

"Am I always right? Of course not, is my job as the CEO the easiest and simplest as y'all think in a tweet?? NO!!"

"Reality is @fundingticks started as a side project by a small team in my group, this little infant became a giant in no time consuming all resources, Tech, Ops, support etc..."

On the specific changes:

"Let's break it down:

- Increased maxloss for all accounts

- 80% split which will be industry standard

- HFT rule which will be a standard as well.

They took and gave, am I with this? NO, will do better.

A scam if they closed shops, did that happen?? NO"

Source: @Khldfx on X/Twitter

The Core Issue: Retroactive vs. New Accounts

The central question in this controversy isn't whether firms can change their rules — they can, and many do.

The issue is: should rule changes apply to existing accounts?

Arguments AGAINST Retroactive Changes

- •Traders paid for specific conditions

- •Changes mid-challenge violate the original agreement

- •Profits earned under old rules should remain valid

- •Creates uncertainty and destroys trust

Arguments FOR the Firm

- •Sustainability requires adaptation

- •80% split is industry standard

- •HFT/scalping rules are common across prop firms

- •Firm hasn't shut down (unlike many in 2024)

Industry Context

The prop firm industry saw 80+ firms collapse in 2024. Firms that survive often cite the need to adjust rules to remain sustainable. However, the standard practice is to apply new rules to new purchases only, not existing accounts.

Your Opinion: Are retroactive rule changes acceptable?

Click to share your opinion on X/Twitter

The Bigger Question: Does Changing Rules Make a Firm "Bad"?

The controversy raises fundamental questions about the prop firm industry that deserve honest examination.

Does changing rules make a firm "bad"?

Not necessarily. Every business must adapt to survive. The prop firm industry saw 80+ firms collapse in 2024 alone. Those that survive must evolve their business model.

The rule changes themselves aren't unusual:

- •80% profit split → This is industry standard (FTMO, The5ers, most major firms)

- •1-minute minimum rule → Many firms have similar anti-HFT policies

- •Increased max loss → Arguably benefits traders with more room to trade

So where did Funding Ticks go wrong?

The issue isn't WHAT changed, but HOW it was implemented:

| The Problem | Why It Matters |

|---|---|

| Retroactive application | Traders signed up under different terms |

| Profits deleted | Money earned under old rules was erased |

| No grace period | Traders mid-challenge had no warning |

| Poor communication | Changes announced after implementation |

| Losses still count | 1-min rule removes profits but keeps losses |

Was this malicious or an oversight?

CEO Khaled publicly admits the company "made mistakes" and "grew too fast." He claims $220M+ in total payouts, suggesting this isn't a firm trying to avoid paying traders.

Scenario A - Malicious Intent

The rule changes were calculated to reduce payout obligations. By retroactively removing profits, the firm saves money at traders' expense.

Scenario B - Operational Error

A fast-growing startup made changes without fully understanding the impact on existing funded traders. Poor planning, not malice.

The truth likely falls somewhere in between. What's clear is that the implementation was handled poorly, communication was lacking, and thousands of traders feel betrayed - whether that was the intention or not.

DealPropFirm Assessment

The Facts:

- •Trustpilot rating dropped from 4.3 to 3.2 within days

- •Multiple traders report $1,000-$21,000+ in profits removed retroactively

- •CEO acknowledges mistakes publicly

- •Firm is still operational and processing some payouts

The Rule Changes (Objective View):

80% split, 1-minute rule, adjusted max loss = Not unusual in the industry

The implementation method = The actual problem

The Core Issue:

Applying rule changes retroactively to existing accounts violates the implicit contract between firm and trader. Regardless of intent, this damages trust and sets a concerning precedent.

Our Recommendation:

| Situation | Advice |

|---|---|

| Active account | Document everything, request payouts immediately, monitor closely |

| Considering new account | Wait 30-60 days for situation to stabilize |

| New to prop trading | Consider alternatives with longer track records |

What Would Restore Trust:

- Grandfather existing accounts under old rules

- Refund or credit affected traders

- Clear communication on future changes

- Independent verification of payout claims

Final Note: We're not here to declare Funding Ticks a "scam" - that's for each trader to decide. We present the facts, the testimonials, and the context.

The company has paid out millions in the past. Whether they can rebuild trust after this controversy remains to be seen.

We will continue monitoring and update this article as the situation develops.

Related Articles

Note: This article covers both Funding Ticks and Funding Pips, which share the same ownership. See our individual reviews:

Looking for Reliable Alternatives?

If you're reconsidering Funding Ticks, here are prop firms with proven track records:

The5ers

4.6/5Since 2016

No time limit, scaling to $4M

FTMO

4.8/5Since 2015

Industry leader, 90% split

Apex Trader Funding

4.7/5Since 2021

Instant payouts, futures

TakeProfitTrader

4.6/5Since 2021

Fast payouts, PRO 90% split

Sources

- CEO Khaled (@Khldfx) Official Response Thread

X/Twitter • December 23, 2025

- Trustpilot Reviews - Funding Ticks

1,352 reviews • Rating dropped from 4.3 to 3.2

- Community Reactions & Trader Testimonials

Compiled from public X/Twitter posts • December 22-23, 2025

- FundingTicks Official Website - 1-Minute Trade Rule & Revamp Announcement

Official Documentation • December 27, 2025

- Community Reactions to FundingTicks Revamp (UPDATE)

X/Twitter: @TraderYush, @Anderson_999, @GabSTrades, @Cranberry, @BhaveshFulmali, @prabhakar9991 • December 27, 2025